India is primarily an agricultural country, and farmers form the backbone of its economy. To address the financial challenges faced by farmers, the Government of Uttar Pradesh has introduced the Kisan Karj Mafi Yojana, aimed at waiving farming loans. This scheme provides significant relief to farmers who have availed loans through the Kisan Credit Card (KCC) but are unable to repay due to poor harvests. Under this initiative, the government is committed to alleviating the burden of loan repayment for small and marginal farmers, ensuring their financial stability and encouraging agricultural productivity.

Eligibility of Kisan Karj Mafi Yojana

- To avail the benefits of this scheme, farmers must meet the following eligibility criteria:

- The farmer must be a permanent resident of Uttar Pradesh.

- The farmer’s landholding should not exceed two hectares (approximately 5 acres).

- The loan repayment period should have already passed.

- The farmer must possess all relevant loan-related documents.

- Farmers who have availed loans under the Kisan Credit Card (KCC) are eligible for this scheme.

- Only applicants whose requests are approved will be eligible for loan waivers.

How to Check the Updated List of Beneficiaries

Farmers can check if their names are included in the Kisan Karj Mafi Yojana beneficiary list using the following steps:

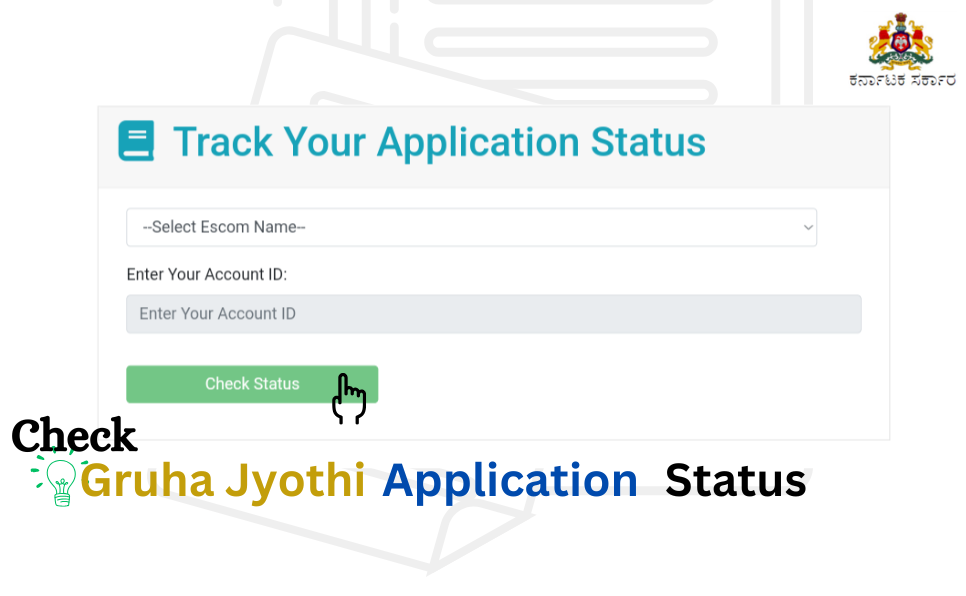

Online Process:

- Visit the official website of the scheme.

- Search for the latest beneficiary list on the homepage.

- Click on the provided link and fill in the required details, such as district and block information.

- Click on the search tab, and the list will appear on the screen.

- Farmers can easily check their names in the published list.

Offline Process:

The beneficiary list is also made available at district offices and Janpad departments for easy access by farmers.

Benefits of Kisan Karj Mafi Yojana

The scheme offers numerous advantages for farmers, including:

Debt Relief: Loan waivers up to ₹1 lakh provide significant financial relief for small and marginal farmers.

Freedom from Legal Proceedings: Farmers are safeguarded from legal actions related to unpaid loans.

Encouragement for Agriculture: Debt-free farmers can contribute more actively and confidently to agricultural activities.

Eligibility for Future Loans: Farmers relieved of their debts can apply for fresh government loans when needed.

More Information About Kisan Karj Mafi Yojana

The Kisan Karj Mafi Yojana was launched by the Uttar Pradesh Government in 2021 under the leadership of Chief Minister Shri Yogi Adityanath. Since its inception, the scheme has benefitted lakhs of farmers by waiving their loans. By 2024, the government plans to extend loan waivers of up to ₹1 lakh to more than 5 lakh farmers across the state.

Key Highlights of the Scheme:

- The scheme prioritises small and marginal farmers who face significant financial constraints.

- Beneficiaries are selected based on their inclusion in the official list of applicants.

- The scheme provides both online and offline access to information and updates.

Kisan Credit Card (KCC) and its Relevance

The Kisan Credit Card Scheme was introduced to ensure timely and adequate credit availability for farmers. Key features of the KCC include:

Subsidized Interest Rates: The government provides an interest subvention of 2% and a Prompt Repayment Incentive of 3%, reducing the effective interest rate to just 4% per annum.

Broadened Scope: The scheme extends to cover allied agricultural activities and non-farm investments.

Ease of Use: Simplified procedures and the introduction of Electronic Kisan Credit Cards make the scheme more accessible to farmers.

By integrating the KCC benefits with the Kisan Karj Mafi Yojana, the government aims to enhance the financial stability of farmers and support their agricultural endeavors effectively.

Conclusion

The Kisan Karj Mafi Yojana is a transformative initiative aimed at empowering farmers in Uttar Pradesh by reducing their financial burden. By waiving loans, the scheme addresses the challenges faced by small and marginal farmers, providing them with the support they need to focus on agricultural growth. Coupled with the benefits of the Kisan Credit Card, the initiative ensures holistic financial assistance, contributing to the well-being of the farming community.

Vikas Kumar holds an MA in Political Science and has a strong background in government projects, having worked on various contractual initiatives aimed at public welfare. He created this website to share essential updates on government schemes, aiming to empower citizens with the information they need to access valuable resources.